Stock and Bond Prices Have Adjusted to the New Normal. Private Market Funds Haven’t—Yet

Alternative asset investing has become a $10-trillion global market by promising outsized gains with less risk. There are numerous difficulties we have with those assumptions, particularly now as an era of elevated rates threatens lofty valuations.

Cameron Scrivens

Portfolio Manager and President

Kai Lam

Chief Investment Officer

It’s important to us for clients to understand where and how their money is invested. For example, we sometimes encounter investors who want to compare the performance of JCIC’s portfolios, which invest in public equities and bonds against funds invested in private assets, like real estate or private equity.

The sales pitch on private assets is that they offer high returns with low volatility. It’s a story that resonated with particular verve as both bonds and equities fell in 2022, while private-equity funds appeared to hold or increase in value.

But did they? As part of our regular assessments of new opportunities within public and private markets, that assumption is one we’ve tended to scrutinize closely. In our view, there has been a large and growing disconnect between the perceptions of private assets and the market realities.

What’s true for apples is also for assets: neither can defy gravity. While listed stocks and bonds have re-adjusted to a landscape of higher interest rates (read: fallen) and priced in recession risks, much of the private credit landscape has yet to reflect this reality for the simple fact that it is not subjected to the daily price action of public markets. Instead, those asset values re-price quarterly or annually and, even then, may not be marked in a way that fully realizes what the market would pay.

Our current view is that a private asset correction is coming—something has to give. Either those funds have to underperform, public assets have to outperform, or it will be a combination of both.

Public Private Disconnect

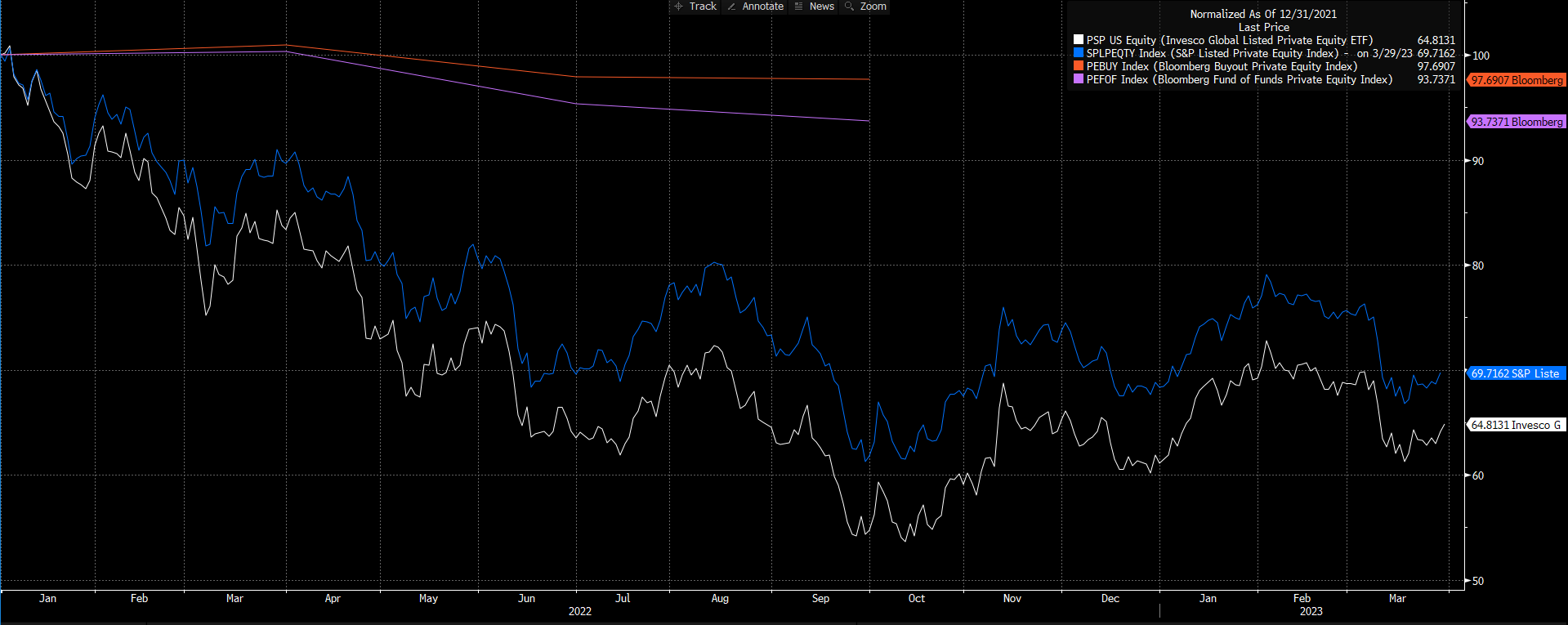

From early 2022 through the first few months of this year, public markets have marked down private equity assets materially. For example, there is a significant delta between listed and non-listed private asset investments. The Invesco Global Listed Private Equity ETF and S&P Listed Private Equity Index, which track the performance of publicly listed private equity companies, have diverged significantly from the Bloomberg Fund of Funds Private Equity Index and Bloomberg Buyout Private Equity Index, two indexes following the performance of non-listed private equity strategies. Invesco’s ETF has declined more than 30% in the period, while the private funds have posted virtually no change in net asset values. Does this make sense?

Source: Bloomberg

To use another example, compare the Dow Jones Equity REIT Total Return Index to the Bloomberg Real Estate Private Equity Index and PGIM Private Real Estate Fund. The only reason the Dow Jones index has fallen sharply against the Bloomberg index appears to be because it tracks public REITs, while the Bloomberg index is based on the net asset values reported by private equity real-estate funds. The former reflects daily price movements while the latter does not. And in the case of the PGIM fund, its value actually jumped in mid-March. It is a disconnect that to us, does not make sense.

Source: Bloomberg

Leverage risk

It’s worth noting a key risk within these funds that can sometimes go overlooked by investors: leverage. Typically, real-estate and private equity investments involve the use of leverage to enhance returns. Yet those higher leveraged returns carry higher risks of default or other financial strain. As interest rates climb, for example, those risks remain while profitability in private portfolios erodes.

In contrast, we do not use any leverage in our investments in public equities or fixed income to enhance returns precisely because it elevates risk. The equities that we invest in certainly use leverage, but we primarily invest in high-quality large cap names that have strong balance sheets and relatively lower leverage.

Cracks Are Emerging

Private funds have benefited from sliding interest rates for decades—it’s been a 35-year tailwind that culminated in an era of ultra-low yields. But we’re not in that environment anymore and alternative asset valuations will have to play catch up. Rates only began moving up a year ago, and while it can take time to funnel through, it will happen eventually.

Cracks are beginning to emerge, spilling into view in the form of momentary redemption freezes. Private credit funds typically hold buffers of cash so that there’s capital for clients to withdraw. But if enough money is taken out too quickly, liquidity disappears and assets must be sold or transactions halted. In December, BlackRock froze redemptions in a $4.2-billion UK private property fund.1 And in Canada, Romspen Investment Corp., a major private mortgage lender, stopped withdrawals in early November amid liquidity concerns.2

Our message is not to steer clear of private credit opportunities—far from it. We are not buyers today, but that does not rule out the possibility we will be tomorrow.

Our point is this: know your risks. Be informed and ask questions. Investors must know what their investment manager owns and understand the risks involved. As with any allocation decision, when reviewing alternative investments, one must adhere to a timeless principle: caveat emptor—buyer beware.

NEWSLETTER

Sources:

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.