Clear the Runway: Signs of a Soft Landing

Written By Cameron Scrivens & Kai Lam

According to a recent Bloomberg survey of more than 2,200 market participants, investors remain starkly divided over where the economy is headed.1

Less than half see a soft landing, defined as inflation slowing to below 3% without growth turning negative. Nearly a fifth of respondents see no landing at all, which we think is optimistic. More than a third expect a hard landing, or a sharp spike in unemployment coupled with a deep economic contraction.

Count us as soft-landing supporters.

The data we’re seeing right now point toward an inflation-lowering scenario that doesn’t break the economy. From labour market numbers to retail sales to high-frequency economic indicators, many if not all signs point in a reassuring direction. Here’s a few of the signposts we see suggesting the sharp recession called for by some in recent months may not materialize.

1. Two Worlds

In a recession, the economy typically experiences a rapid increase in the unemployment rate—but we're just not seeing any indication of that. The U.S. and Canadian unemployment rates are historically low and labour markets remain exceptionally strong (see chart below).

Source: JCIC Asset Management Inc.

We are, however, seeing a tale of two job markets. Large-cap tech firms that saw sales skyrocket during the pandemic initially scrambled to boost headcounts and that is where the job weakness primarily resides as sales fall back to earth.

On the other hand, the services industry—which is a far bigger support to the economy—is hiring. Harvard economist Raj Chetty recently calculated that there were 2.6 million U.S. workers who left the job market when the pandemic hit.2 Many of those workers may now be streaming back, enticed by wage gains driven by still-robust labour demand. The chart below shows the U.S. labour force participation rate, which suffered a steep drop in 2020, is now edging higher again.

U.S. Labour Participation Rate

Source: Bloomberg

2. Upside Surprises

We also track the Citigroup Economic Surprise Index, which shows how frequently actual economic results exceed forecasts. Globally, the data has trended up since the beginning of the year (see chart below), and regionally the story is largely the same. The high-frequency economic measures we’re watching for Canada, the U.S., the Eurozone—and even Japan—are pointing to improved macro conditions relative to previous estimates. This does not necessarily mean the numbers are outstanding, but rather that the pessimism was excessive.

Source: Citi Economic Surprise Index

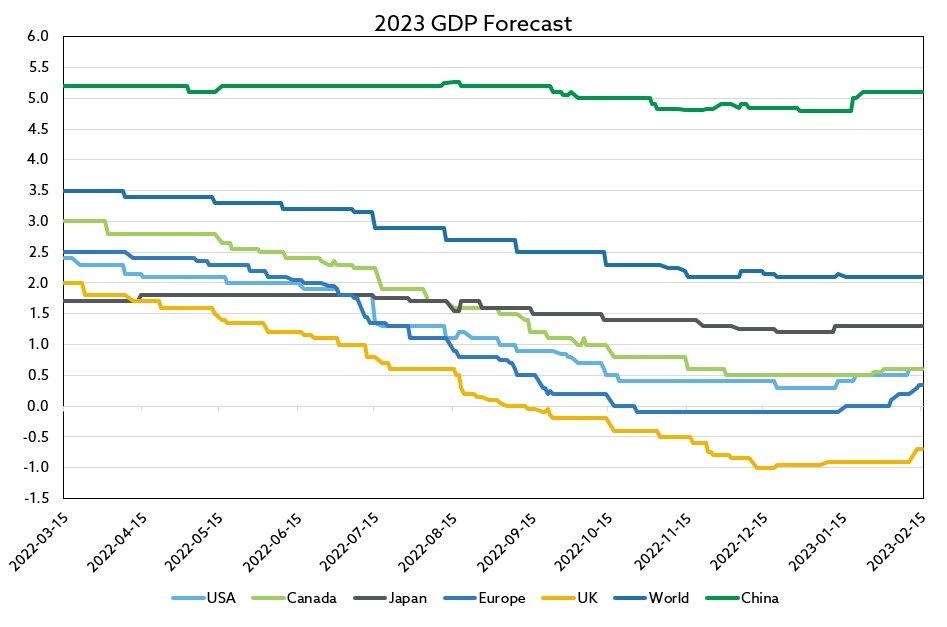

The more resilient macro picture is now rippling into overall growth forecasts. If you look at 2023 GDP estimates, after hitting a trough between mid-December and January, revisions are now coming in higher.

Source: JCIC Asset Management Inc.

3. Still Spending

The jobs and other data are being supported by the consumer, especially in the United States, who continues to spend on goods and services.

Experiential outlays are leading the charge, but the spending extends beyond services. U.S. department-store sales were up double digits in January. Furniture and clothing popped. All in all, the U.S. consumer put in their strongest monthly showing in nearly two years to start 2023.

U.S. Retail Sales

Source: U.S. Census Bureau via St. Louis Fed

Where is this money coming from? Earned income is one source, but so too is the pandemic savings glut still being worked down. Morgan Stanley estimates that roughly 30 per cent of the $2.7tn cash bulge U.S. households built up over the pandemic has been spent.3 There’s room for more shopping—though that comes with a caveat: lower-income households have largely exhausted their excess savings, which is something we’re watching.

Second-Half Concerns

To be sure, there remains risks to a soft landing. The string of strong data is a threat for markets in particular. Investors were penciling in a 5.25-5.50% terminal rate from the Federal Reserve by July. That’s now moving higher as the economy hums and inflation fails to descend as quickly as central bankers would like. Markets are feeling those higher rate pressures once again.

There are also the macro risks posed by previous hikes, notably in Canada, where comparatively levered households are particularly sensitive to higher rates. If it takes roughly four to five quarters for monetary policy decisions to fully integrate into financial conditions, the complete effects from those outsized 75-basis point hikes made by the Fed and Bank of Canada last year have yet to arrive.

As custodians of our clients’ money, it’s vital we take these economic considerations into account when deciding where to put capital. We are monitoring this debate very closely and, all in all, we believe a hard landing will be avoided and in the coming months the data will support that thesis.

NEWSLETTER

Sources:

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.