Rising Defence Budgets Present Opportunity to Go on Offence

REGIONS IN FOCUS

CANADA

Canada has proven more resilient than expected to higher rates; however, a soft landing could be in jeopardy if overleveraged households slow their spending and exacerbate a broader slowdown

Longer duration bonds have become more attractive as yields rise

Markets are pricing in at least one more 25-bps rate increase from Bank of Canada

U.S.

Consumer stocks have attractive entry points considering households are employed and spending

Similar to BoC, the Fed’s terminal rate expectations are increasing

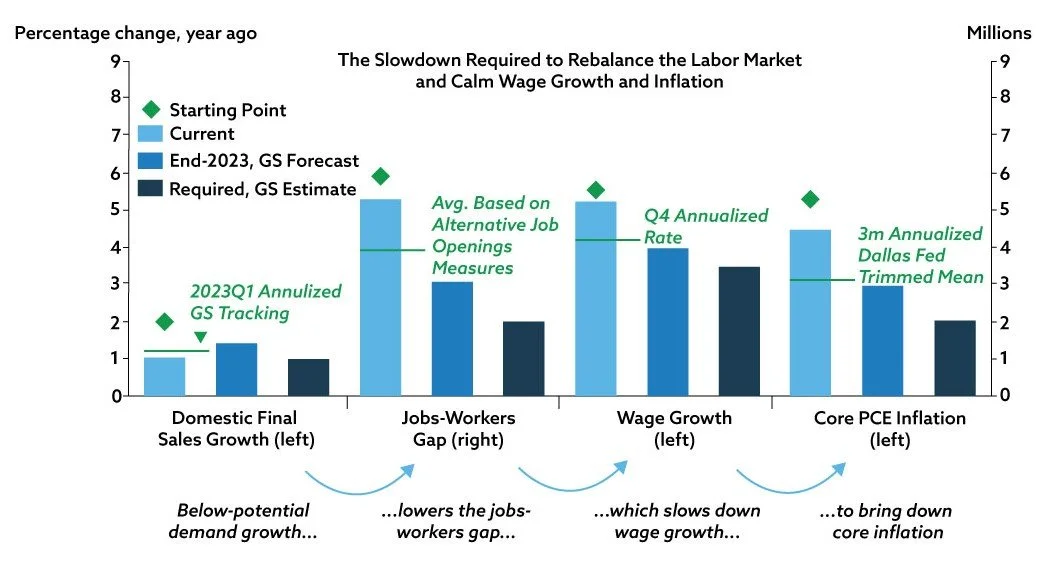

U.S. economy still trending toward ‘soft landing’, as illustrated by the chart below

We Have Become More Optimistic About a Soft Landing Because Incoming Data Show That All Four Steps of the Rebalancing Process Are Underway

Source: Goldman Sachs (February 13, 2023)

INTERNATIONAL

Still bullish on Europe’s economic resilience and the China reopening theme, but upsides are increasingly priced in

Defensive stocks have sold off, with opportunities now emerging

MARKET WATCH

What we’re overweight - Energy

Energy equities both within Canada and internationally have done well over the past year yet the sector remains cheap, and poised to generate still-elevated cash flows at present prices. We see continued buybacks and dividend increases.

What we’re reducing - Cash

We’re less underweight on fixed income, and have therefore started deploying more cash. Longer duration yields have improved, and though there’s been some near-term pressure, we’re buying duration and locking into what we see as attractive, stable returns.

A look at some of the companies we’re buyers, holders or sellers of right now:

| Company or issue | Buy, Sell, Hold | Thesis |

|---|---|---|

| Rheinmetall AG (Ticker RHM.DE) | Buy | Rheinmetall AG is a German-based group primarily focused on land-based military products. Europe is entering a major defence spending upcycle and the company’s sales should double from 2021 to 2026, with profit growing significantly more than this. The company offers visible double-digit revenue growth, expanding margins, improving returns, and has a strong balance sheet. The war in Ukraine and rising geopolitical tensions globally have contributed to rising defense budgets. RHM is the manufacturer of Leopard 2 tanks being sent to the Ukraine by multiple countries including Canada to defend lives and territory. The company will also deliver additional service, parts, maintenance and ammunition for these vehicles which provides upside to current earnings expectations. |

| Novo Nordisk A/S (Ticker: NVO.NYSE) | Hold | Novo Nordisk A/S is a leading global pharmaceutical company based in Denmark. Their purpose is to defeat Type 1 and 2 diabetes and other serious chronic conditions such as obesity, rare blood and endocrine diseases. NVO has industry-leading market share in diabetes care, supported by one of the broadest product portfolios. In addition to secular growth in diabetes care, growth is driven by newer treatments than can be administered orally or with less frequent injections. A less mature and fast-growing area for the company is weight loss treatment through the drug Wegovy (and Ozempic) which we see as a driver for higher earnings estimates. The company offers an above average growth profile, strong free cash flow, leading competitive position, high return on equity, almost no debt, and a history of a high dividend payout ratio, growing dividends and share buybacks. |

| Provincial bonds | Buy | Canadian provincial bonds with duration of between 2- and 10-years offer guaranteed returns that we see as attractive over medium- to longer-term. |

NEWSLETTER

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.