Third Quarter Performance Report

The third quarter of this year (July, August, and September 2024) provided a powerful reminder that all markets are international: Actions by governments and companies on the other side of the world directly impact our strategy and our results.

JCIC is excited to report that we have made solid gains in many sectors over these past three months. Kai Lam, our Chief Investment Officer, provides these details:

Kai Lam, Chief Investment Officer

The third quarter of 2024, markets continued to post positive returns, but the factors driving those gains have changed. This volatility came from numerous headlines, including:

Mixed US economic dataAn interest rate hike in Japan that prompted the reversal of the Yen carry trade (borrowing at low rates in Japanese Yen and reinvesting proceeds in other markets such as the US)Rising tension in the Middle EastInterest rate cuts in Canada, Europe, UK and the USChinese stimulus announcementsUS election uncertainty

Impact on Specific Portfolios

Our JCIC Balanced Fund was up 3.6% in Q3 and 14.1% year-to-date (YTD). Our JCIC Equity Fund returned 4.1% during Q3 and 17.9% YTD. The TSX played catch-up during the quarter, posting a double-digit return. Our Canadian equity positions performed very well, with Brookfield Asset Management up 24%, Agnico Eagle Mines Ltd. up 22%, and positions we added earlier this year, with FirstService Corporation up 19% and Sun Life Financial Inc. up 18.3%. Top performing stocks in the US included Home Depot (+16.9%), United Health Group Inc. (+13.8%) and Apple Inc. (+9.3%). Within international markets, Axa (+16.4%) and Deutsche Telekom AG (+15.3%) were strong performers for Q3 (all figures are in Canadian Dollar terms). Leadership shifted into companies that are more defensive or interest rate sensitive. Growth concerns also pressured interest rate expectations, driving bond yields lower and fixed income returns higher.*

Changes to Central Bank Interest Rates

During the quarter, we saw a continuation of rate cuts in Canada and Europe and the first rate cut from the US of 50 basis points. We can see this in Figure 1.

Figure 1.

Source: Bloomberg

Inflation Watch

We expect multiple interest rate cuts this year and next, with inflation descending to the 2% target. Figure 2 shows inflation in different regions, represented by the Consumer Price Index. Inflation has come down significantly, with some regions already reaching 2%, giving flexibility to cut rates further.

Figure 2.

Source: Bloomberg

Broad Economic Trends

In addition to lower inflation, rate cuts are also supported by slowing services and manufacturing PMI (purchasing managers index), showing weakening momentum (Figure 3) and rising unemployment (Figure 4) in multiple markets.

Figure 3.

Source: Bloomberg

Figure 4.

Source: Bloomberg

Is China going to help?

Chinese growth has been decelerating for some time with a weak real estate market and a very downbeat consumer unwilling to spend. Until recently, the Chinese government has not taken aggressive measures to support economic growth. However, the China Politburo meeting delivered more aggressive growth measures than we have seen for a long time. This included interest rate cuts, lowering the bank RRR (reserve requirement ratio), lowering down payments required for second homes, providing a mechanism for asset managers and insurance companies to get liquidity to support the equity market and providing access to low-interest loans for public companies to buy back shares.

President Xi emphasized the need for fiscal policy measures (government spending) and the monetary policy measures announced. Given how weak economic data from China has been, these measures themselves will only be enough if they apply further measures. However, the market has taken the change as a decisive shift in government policy. It has resulted in Chinese shares rising over 25% over several days off of depressed levels and low valuation. We continue monitoring that market closely and looking for evidence of policy success.

Equity Markets

As mentioned above, equity market leadership has shifted over the past few months. As we can see in Figure 5 and Figure 6, the S&P 500 versus the equally weighted S&P 500, the index performance has been catching up in Q3 after lagging in the year's first half. The equity market performance has been broadening out.

Figure 5. S&P 500 Index (Black line) vs. S&P 500 Equally Weighted Index (dotted line) Year-To-Date performance

Source: Bloomberg

Figure 6.

S&P 500 Index (Black line) vs. S&P 500 Equally Weighted Index (dotted line) Q3 performance

Source: Bloomberg

Top Performers

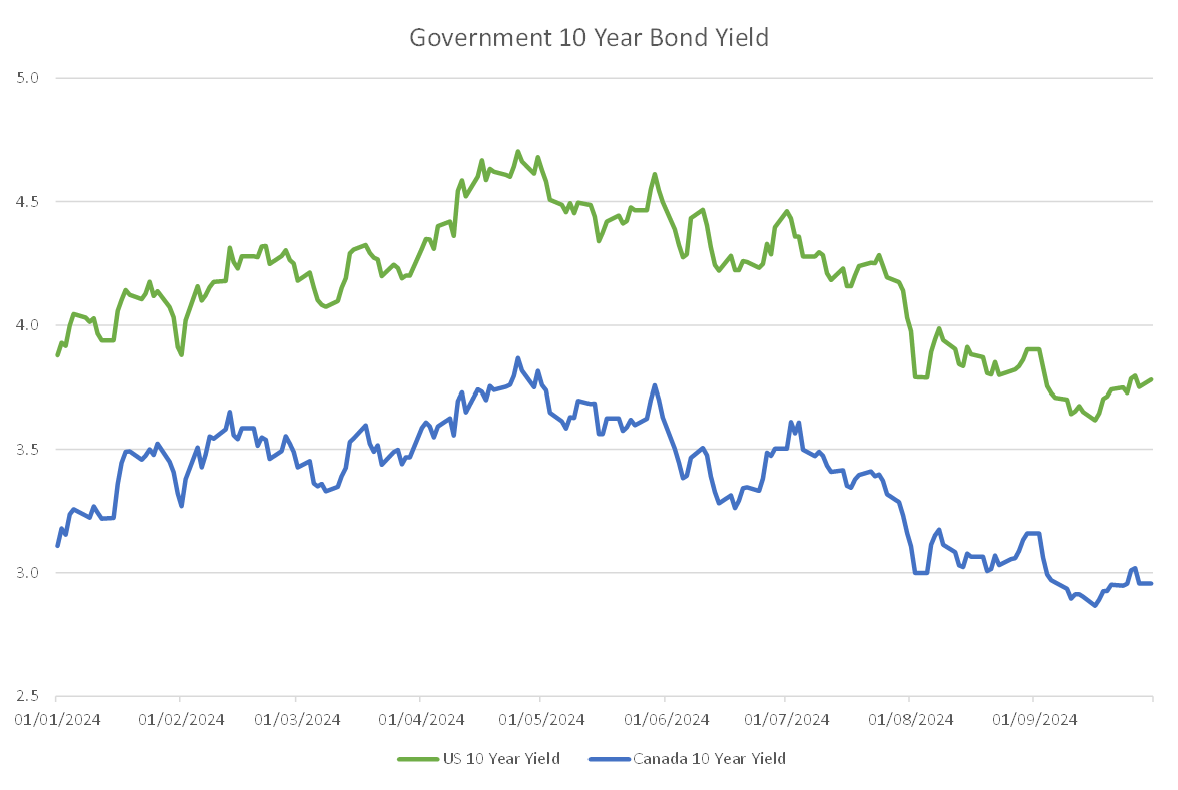

We can also see leadership changing. In Figures 7 and 8, we can observe that over the last few months, top sectors include utilities, real estate, and financials, which are all interest rate-sensitive and dividend stocks. This has happened at the same time as bond yields have declined. Figure 9 shows the dramatic decline in bond yields as growth concerns surfaced and inflation rates have declined.

Figure 7.

S&P 500 Q3 Group Returns

Source: Bloomberg

Figure 8.

S&P/TSX Q3 Group Returns

Source: Bloomberg

Figure 9.

US and Canadian 10 Year Government Bond Yield

Source: Bloomberg

Forward Focused Strategy

We will continue to be tactical within our fixed income exposure as the market has continually been shifting back and forth between many rate cuts and modest rate cuts. We favour shorter-duration bonds that can still see lower yields as rate cuts come through and offer attractive current yields. However, we see less upside on longer duration bonds which have already factored in significant future rate cuts.

Within equities, we are cognizant of the higher valuation multiples in the S&P 500 (Figure 10) at almost 22x P/E (price/earnings) and about 15% EPS (earnings per share) growth forecast for 2025. However, earnings estimates have also been more resilient in the US, with continued improvement in productivity supporting growth and a resilient labour market. The equally weighted S&P 500 valuation is not excessive (Figure 11), nor is valuation in other markets such as Canada (Figure 12) or internationally (Figure 13).

Figure 10.

Source: Bloomberg

Figure 11.

Source: Bloomberg

Figure 12.

Source: Bloomberg

Figure 13.

Source: Bloomberg

Final Thought

Currently, we have adopted a barbell strategy, where one end of the barbell is secular growth and the other end is defensive and favours interest rate sensitive stocks that underperformed due to high interest rates over the past months. We have full confidence that this strategy will continue to deliver on expectations.

If you have questions about any of this information, please don’t hesitate to reach out to us:

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.

* Performance percentages stated are gross of fees.