Q3 2022 Commentary

JCIConnection

There is light at the end of the tunnel.

As we head into the final quarter of the year, the theme of market volatility in 2022 will continue into year end. We are remaining calm and disciplined in our investment approach.

Seasonality remains supportive of stocks heading into fourth quarter based on historical analysis (Figure 1). In addition, third quarter corporate earnings are set to kick off soon and we believe another quarter of better-than expected results could help convince investors that an earnings collapse is not an inevitability and, instead, earnings resilience can persist. We believe it is also important to note that while there is still plenty of uncertainty in the market, there is now also plenty of value beneath the surface for investors focused on stock picking, with roughly two-thirds of S&P 500 stocks carrying below-average next-twelve-month PE multiples.

For a market that has become familiar with risk, it is clear investors have yet to make up their minds on what this could mean for equities in the near term. With the volatility and headlines whipsawing markets, investors have been hard-pressed to discern between idiosyncratic and market-driven risk. The upcoming corporate earnings cycle will separate the winners and losers after what has felt like a series of market head fakes over the past few months.

Seasonal Price Trends Point to U.S. Stocks Moving Higher in Q4

The impact of the Federal Reserve Bank’s actions.

Although the mantra for months has been “don’t fight the Fed,” many seem to question whether the Fed will ultimately commit (or be able to commit) to a path toward prolonged higher rates. FOMC members have remained resolute on a pledge to squash inflation, notably emphasizing the need to raise rates up to 4.5% without a quick turnaround in 2023. One would think we’d have learned from former Federal Reserve Bank Chairman Paul Volcker’s moves in the 1980s and the ramifications of cutting rates too soon. Yet it is hard to justify causing the same economic pain today.

Examining the US economy more broadly, the degree of financial tightening (so far) is in line with Fed policy goals, with financial intermediation not sending signals of dysfunction. Financial stability will remain a key focus for the Fed. However, market dysfunction, not general tightening, will force policymakers to act, with targeted interventions a much more likely first response than a wholesale change in the policy path.

It is only a matter of time before the Fed backs off its tightening cycle, which will cause stocks and other risk assets to rally sharply. The decline in US stocks since mid-August has been severe and long-lasting. We are staying calm and disciplined and not going into panic mode amid this selloff. Yes, the market has been volatile, and the path of least resistance has been to the downside in recent weeks. However, we firmly believe that the markets will find their footing. Seasonality remains supportive of stocks heading into Q4. The >20% loss during the first nine months of the year only adds to the strength in seasonal price trends for the final quarter. In addition, Q3 corporate earnings are set to start.

Upcoming U.S. Mid-Term Elections.

The US mid-term elections are fast approaching. The likelihood of a Democratic Senate and GOP House is the most probable outcome, estimated at ~44%. Republicans have closed the funding gap in tight Senate races, mainly attributed to Super PACs, which should help fund a spike in advertising. With less than one month until Election Day, the betting odds are below.

What happened during the Third Quarter?

The third quarter of 2022 was very mixed. A strong market bounce early in the quarter faded in the latter portion of the quarter. The TSX Composite total return declined 1.4% during Q2. The S&P 500 total return increased 1.9% in Canadian dollar terms (down 4.9% in US dollars). The MSCI EAFE (non-North American developed markets) descended 2.9% in Canadian dollars. The fixed-income market was relatively flat.

When we look at global sector performance during the quarter, positive performance was demonstrated by consumer discretionary, energy, and industrials, which are more cyclical sectors. The weakest sectors included communication services, real estate, and utilities. These defensive sectors became relatively expensive compared to non-defensive ones, thus becoming vulnerable to a narrowing of the valuation differential. Rising interest rates also hurt them as investors treat the dividend yield as a bond proxy.

During the quarter, inflation did show signs of peaking in multiple markets. However, it has not come down as quickly as anticipated (Figure 3). While we have seen significant corrections in energy and commodity prices, inflation has spread broadly.

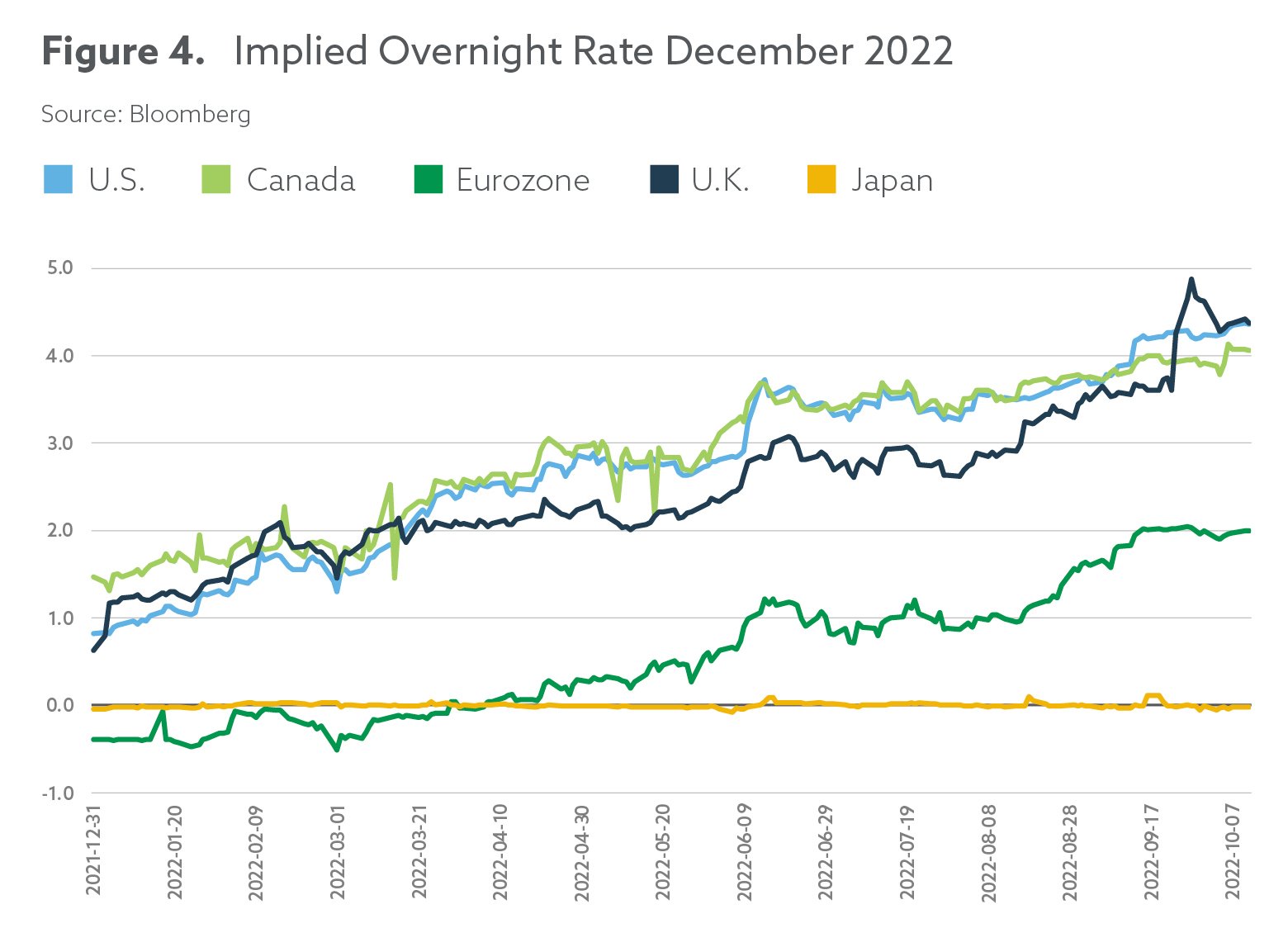

As a result, the stabilization of rate hike expectations accelerated upwards again, prompting market volatility. Figure 4 demonstrates how much expected central bank rates for December 2022 have risen since the start of the year.

With such expected rapid hikes in interest rates, recession fears going into 2023 have dominated market sentiment.

In previous Commentaries, we discussed that inflation accelerated from pent-up demand after the COVID-19 recovery, supply chain disruptions, the Russian-Ukraine war, government economic support, low-interest rates, and a very tight labour market. As shown in Figure 5, the unemployment rate remains very low globally. We have not seen a significant increase in the unemployment rate, which usually occurs going into recession. We have witnessed layoffs from high-growth companies with low profitability. However, layoffs have not been broad-based, and companies are reluctant to let workers go for fear that they will be hard to hire back.

With the backdrop of persistently high inflation (high energy costs, high food prices) and rapidly rising interest rates, the recession scenario is likely in 2023. However, the depth of the recession remains unclear. We are in an environment where markets look to interpret bad news as good news and vice versa. Suppose economic data such as unemployment and growth are not showing enough weakness. In that case, the market will anticipate higher rate hikes which could result in a “harder landing” recession. However, if economic data deteriorates, the market will give credit to the effectiveness of central banks in slowing down the economy to tame inflation.

Positioning our Portfolios for Success.

We have kept fixed income exposure on the lower end of its historical range. Duration (time to maturity) is shorter than the overall bond market, and our corporate bond exposure is similar to our government bond exposure. We expect to deploy some of our cash into additional fixed-income exposure to exploit increasingly attractive yield to maturity on bonds.

We have not changed our equity exposure since reducing it across the board during the second quarter. Overall equity exposure is modestly above the benchmark.

As we get closer to more visibility on the earnings outlook (estimates need to decline to reflect recession risk), we will look to deploy some cash into compelling opportunities in the equity market.

The current market valuation looks compelling, with Canadian (Figure 6a) and International markets (Figure 6b) trading well below one standard deviation below their 10-year average.

The US market (Figure 6c) is almost trading at one standard deviation below its average. It is skewed upwards from more expensive mega caps. The median S&P 500 stock is trading below the average.

Despite low valuation, earnings estimates have yet to show enough weakness to make the current valuation realistic. It is unclear how much they will be cut, but this will be key in determining how inexpensive the market is.

As we can see in Figures 7a and 7b, 2022 EPS estimates have peaked for the S&P 500 and the TSX, but they have been very modest and still represent higher growth than expected at the start of the year. Current EPS (earnings per share) estimates look for S&P 500 earnings growth of 7.1% in 2022E and 8.1% in 2023E.

The S&P TSX Index estimates EPS growth of 20.9% (helped by energy and resources) in 2022E and 3.5% in 2023. Lastly, the MSCI EAFE index is looking for earnings growth of 1.4% in 2022E and 3.1% in 2023E. The market does not believe these growth projections. That said, even if earnings estimates are cut by 5%, 10% or 15%, the adjusted valuation is not expensive. Equities should perform better once we get more clarity on what earnings will actually be.

As we have indicated in the past, the biggest driver of equity market performance is ultimately determined by earnings growth and cash flow generation through recessions and economic expansion. Currently, the market has been volatile as it tries to discount rising interest rates, slowing growth, recession risk and earnings downgrades. We do expect the rapid rise in interest rates to have the desired effect of reducing growth and bringing down inflation. We believe market performance will improve as we see progress on this and get visibility on its impact on company earnings.

As we take a three- to five-year view of our positions, we see very compelling investment opportunities within our portfolios.

New additions to the JCIC Asset Management Team!

We want to extend a warm welcome to Tim Holley, Director of Business Development and Adam De Vos, Client Services Manager, to the JCIC Asset Management family.

Please join us in welcoming Adam and Tim to the JCIC Team!

Both Tim and Adam look forward to meeting everyone.

Did you know we have a Financial Planning Service

for our clients?

One of the many benefits of being an investor with JCIC is complimentary access to our financial planning service. We help you establish investment goals, both short- and long-term, and develop a strategic plan to get you there. Whether you need help saving for a large purchase, planning out your retirement, optimizing your tax situation, or ensuring your estate is in order, our Financial Planning service will be available to help you through the process every step of the way.

If you are interested in seeing how Financial Planning might help you, contact Godfrey Yu and book an appointment today.