The key to growth is starting early

Our June newsletter focuses on young people and the importance of having a long-term outlook.

Sustainable inter-generational wealth is an ambitious goal, but we have an approach that we know works.

Kai Lam

Update from JCIC’s Chief Investment Officer

May was another strong month for our portfolios, with positive returns across cash, fixed income, Canadian, US and International equities. I want to highlight the solid performance of our Canadian equities, which year-to-date has returned over 14% compared to the S&P TSX total return index, providing a return of 7.6%. Our proprietary investment process allows us to be nimble in the Canadian market. Indeed, our significant outperformance within Canada has been as much about owning the right high-quality stocks as it has been about avoiding most of the underperforming companies and sectors within the TSX. Currently, we are starting to take profits on some of our best-performing positions as they have become more fully valued and are rotating into other strong companies that have underperformed where we see a positive outlook and attractive valuation.

Spreading the Word

Politics, retail habits, and artificial intelligence are all having an impact on the US markets. JCIC President Cameron Scrivens appeared on BNN television to share with Canadians what to look for as we move into summer. Watch it here.

Reaching Out

We hosted a ‘Young Investors Meetup’ at our offices in May. Some of the attendees were the adult children of our current clients, and some were brand new to the JCIC family. The recurring theme of the evening was the importance of investing for the long-term.

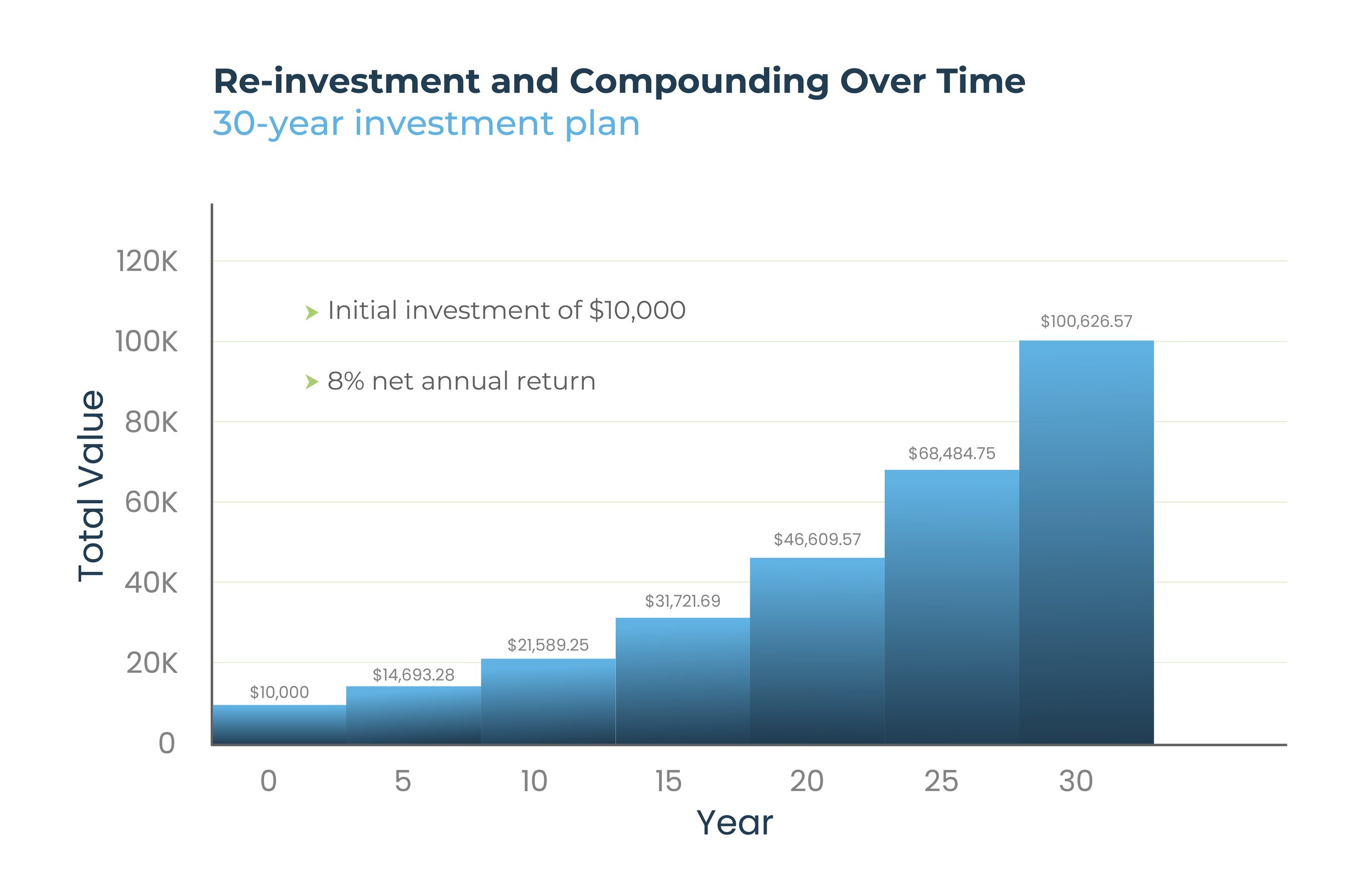

This chart shows the impact of re-investment over time. It shows a theoretical 9x return, even without any additional investment, over 30 years. This illustrates the philosophy of prioritizing ‘time in the market’ over ‘timing the market.’

“All the attendees were eager to learn more about investments and what options are available to them,” said George Youngberg, Associate Relationship Manager at JCIC, who was one of the hosts of the event.

“While younger people might not have a lot of assets to invest, they can take advantage by leveraging time,” he said. “By starting to invest early, even with small increments, they can benefit from the compounding of their returns over the long term.”

“Young people can get a big head start in securing their financial future by starting to invest early and regularly,” added Michelle Burandt, Relationship Manager at JCIC, who was also a host. “Even if they only have $100 a month to tuck away, their savings will compound and grow, since time is on their side.”

The other topic that came up at the event was what to do with the plethora of online platforms and tools for doing your own investing. While those certainly fill an important niche, they don’t replace the personalized approach of a boutique firm such as JCIC.

“Our clients have the benefit of personalized advice and guidance from their Relationship Managers,” says Burandt. “When you are designing a long-term investment strategy, there is a lot more to it than just deciding what stocks to buy.”

Youngberg wrapped up the evening with a simple promise. “We’re here to support your family’s wealth plan,” he said. “Sustainable inter-generational wealth is an ambitious goal, but we have an approach that we know works.”

If you have a young person in your family that has questions about investment strategies, please urge them to have a conversation with Michelle or George. They can help them understand their options today, and in the future.

Investing Our Time

JCIC believes in investing our time with kids. Our Client Service Manager, Adam De Vos is coaching the Pickering Red Sox this summer, and JCIC is the team’s financial sponsor.

Pickering Baseball Association is focused on getting as many kids as possible out on the diamond and having fun. To that end, they rely on corporate sponsors to subsidize the cost of field rentals and uniforms. They also make use of volunteer coaches such as De Vos.

“I played as a kid and baseball is still a big part of my life as an adult,” he says. “That love for the game is something I want to pass along to these kids. If they’re still playing baseball into their adult lives, then my job as a coach is a success.”

The Red Sox are classified as a “Select” team. It’s made up of eight- and nine-year-old players that are getting their first taste of competitive baseball. They have been selected from house league teams and are being given the opportunity to take their game to the next level. They train all winter (three times a week) and play a full schedule of games and tournaments over the summer.

“They talk about baseball constantly,” says De Vos. “They all think they are going to be the next Shohei Ohtani. I don’t know if they will, but they are certainly trying their best.”

It isn’t just baseball; the coaches took the team bowling in April and has plans for other team-building activities this summer.

Upcoming dates to remember

· Sunday June 16th – Father’s Day

· Sunday June 30th – Federal deadline for filing corporate tax returns (fiscal 2023)

· Monday July 1st – Canada Day

· Thursday, July 25th – JCIC’s client appreciation evening with Toronto Summer Music

Receive our monthly newsletter direct to your inbox

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.