ESG ABCs at JCIC

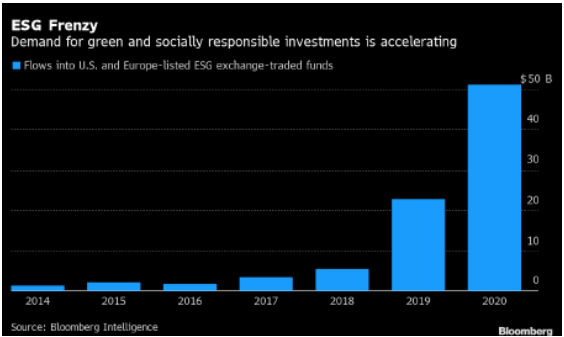

The ESG acronym has grown in awareness significantly over the past several years. ESG stands for Environmental, Social and Governance. It is increasingly becoming part of the investment process and we expect this trend to continue going forward. As we can see in Figure 1 the growth in ESG funds flow has been rapid. But what does ESG really mean and how is it incorporated in our investment process? What does it mean in terms of opportunities, returns, and risks?

Figure 1

There are hundreds of ESG factors that a company can be measured on, which are metrics that are different than traditional financial statement measures. ESG factors can have a financial impact to a company's value. As a consequence, it is important to assess each of our investment's potential risk and opportunities within an ESG framework. This value is not to be mistaken for Corporate Social Responsibility (CSR) which is more focused on "values".

As we mentioned, the "E" in ESG stands for environmental which involves the environmental impact a company can have on the natural environment. Factor examples include pollution and emissions, resource consumption (water/energy) and impact on climate change. The "S" stands for social which considers people and relationships. Different social factors include company gender and diversity, human rights, data protection and privacy, pay equity, and labor standards. Lastly, "G" stands for governance which could look at corporate board composition and independence, bribery and corruption risk, and executive compensation. Figure 2 shows additional examples of ESG factors.

The incorporation of ESG as part of the investment process is not the same as Socially Responsible Investing (SRI) or Impact Investing. SRI limits the investment universe due to exclusionary criteria. Impact investing targets a positive environmental or social impact through investment. Both SRI and impact investing are more focused on values rather than value. However, what ESG integration does do is identify both potential opportunities and potential risks as a result of a company's exposure to ESG trends and the management of ESG issues. Integrating ESG does not mean it limits the investment universe. Rather it provides additional criteria or perspective into a company that may lead to improved risk adjusted returns.

ESG is still evolving rapidly and there is no standardized method of ESG reporting. There are also many ESG research providers with very different methodologies to ratings. Company disclosure of ESG factors also varies widely. At JCIC we use multiple sources of research. We subscribe to independent research providers including Sustainalytics and Bloomberg. We also assess company disclosures from regulatory filings, company presentations and sustainability reports. While some ESG factors are more easily measurable, many are very subjective. As such, we are required to assess all of the qualitative and quantitative data and use our own judgement or opinion to assess the ESG risk and opportunity at the company level.

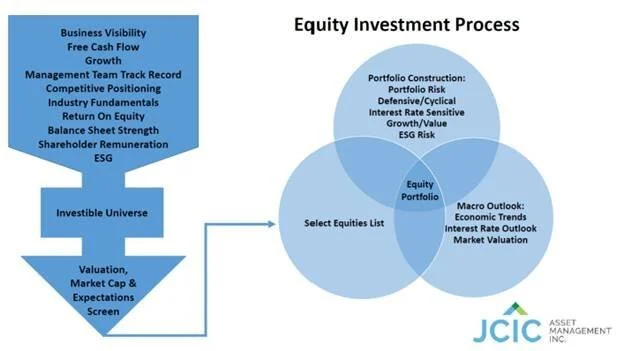

At JCIC we incorporate ESG through both bottom up stock picking and portfolio construction (Figure 3). Our bottom up fundamental analysis already looks at a company's traditional factors such as valuation, free cash flow generation, balance sheet strength, return on equity, earnings growth, earnings visibility, management team track record, shareholder remuneration, industry outlook, and competitive positioning. Now we incorporate ESG as part of our company analysis and measurement of value, opportunity and potential risk. In addition, after we assess each investment's ESG risk, we look at the weighted average exposure of the entire portfolio. We compare this exposure to the overall investment universe. For example, if we look at the JCIC Balanced Fund, the weighted average Sustainalytics ESG risk score is 21.9 (medium ESG risk) out of a scale of 1-100. The lower the score, the lower the risk. This score represents the 28th percentile of the entire Sustainalytics investment universe of over 7000 global stocks which averages a score of 25.9 (medium ESG risk).

Figure 3: ESG within Investment Process

Enel SpA (Italy) is a good example of one of our equity positions where we see an ESG opportunity. Enel is one of the largest power utilities in Europe with global operations primarily across Europe and South America. Sustainalytics rates Enel's ESG risk as 23.4 medium risk. This is good enough to rank in the 33rd percentile globally and 12th percentile within the utilities industry group. Enel has a very strong corporate governance and ESG disclosure score and is considered low risk in this respect. Strong corporate governance is an attractive trait for any investment. We see a good investment opportunity within the environmental angle for Enel. We believe the global trend towards decarbonization is here to stay. Enel is the world's largest producer of renewable energy sources (RES) when we include power production from wind, solar and hydro. Growth in RES capacity will allow the company to grow net income by 8-10% per year for the next three years with good visibility. They are also targeting to grow the dividend (current yield 4.2%) by at least 7% per year over the same time period. Despite large renewable power capacity, the company still scores a medium environmental ESG risk profile due to its exposure to traditional power generation from coal. Currently 54% of power generation comes from renewable sources. However, coal fired capacity will be phased out completely by 2027. As such, we believe the company's ESG score will improve over time from medium risk to low risk as they make progress on decarbonization and exploiting the strong demand for renewable sourced power generation.

Will incorporating ESG into the investment process improve long term returns? There is evidence that investment in companies with strong ESG ratings or avoiding companies with very poor ESG ratings can help mitigate earnings risk. Data is mixed in terms of potential share price outperformance with just investing in high ESG scoring companies and data is very inconclusive when examining SRI and impact investing performance. However, when combined with traditional fundamental analysis we believe we can improve long-term risk adjusted returns by incorporating ESG.

At JCIC we believe that the trend towards ESG as part of the investment process will continue to grow which has demonstrated an acceleration over the last couple years. We have taken the steps to incorporate ESG risk within our investment process at the individual company and overall portfolio level. We do believe that focusing on ESG trends can lead to opportunities, help avoid potential risks and potentially contribute to stronger long-term returns.

JCIC Asset Management Investment Team