Benefits of International Equity Investing

Currently, Canada makes up 2.7% of the global equity market capitalization. This means there is another 97.3% of opportunities outside of our boarders. It was only back in the year 2000 that the Canadian government increased the foreign RASP limit from 20% to 25%, raised it again to 30% in 2001 and removed any restriction in 2005.

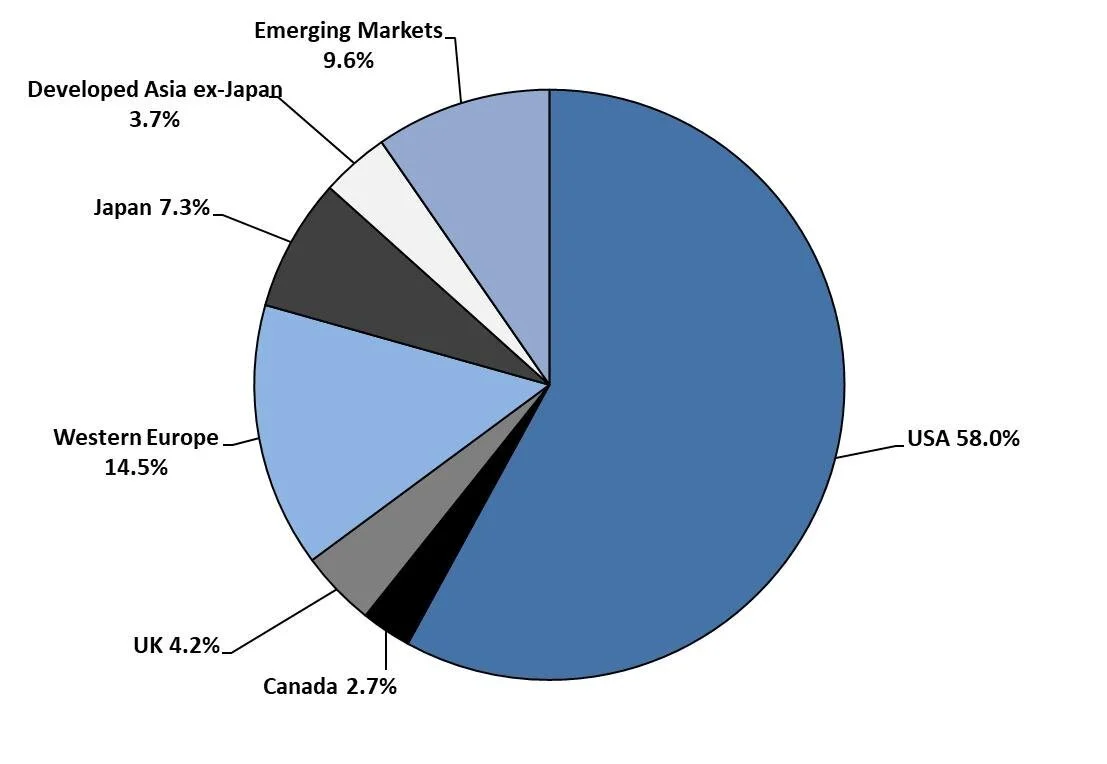

In Figure 1 we can see which segments make up the global equity market. Canada is currently 2.7% of the global equity market, the USA is the largest market with 58% while the rest of the developed markets such as Europe and Japan contribute 29.7% and emerging markets are the remaining 9.6% of which China is 4.7%. Naturally, after Canada, the next logical place for Canadians to invest has been in the USA, home to some of the biggest companies in the world just to the south of us. But what about the other 39.3%?

Figure 1: MSCI All Country World Index Composition

In this piece we would like to address why international investing is appropriate for anyone’s investment portfolio. To start off, we would like you to think about how you make your consumer purchase decisions. What brand of car you drive? Is it a BMW (German), Toyota (Japanese) or Hyundai (Korean)? If you own any luxury watches, it is highly likely it is European, such as a Tag Heuer (Swiss) or Cartier (French). If you have multiple luxury hand bags it could be a Louis Vuitton (France) or Gucci (Italy). When we buy things for ourselves (or others), we buy brands from all over the world to find the best fit for what we are looking for. We do not necessarily limit ourselves to things that are only Canadian or US made. The same thing applies to investing in global equities. International investing provides more choice in order to choose the best companies anywhere and may provide exposure to market segments not well represented in North American markets. In this example, when it comes to automotive OEMs (original equipment manufacturer) there are great global brands available in Europe, Japan and Korea. While brands exist in the US as well, they are not always the best choice at any given time. In the luxury space, there are some public companies available in North America too but the vast majority of luxury brands come from Europe.

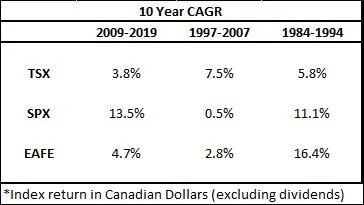

Global investing can also provide diversification, lower portfolio volatility and enhance returns. Chart 1 looks at 10 year equity index returns in Canadian dollars for the TSX, the S&P 500 and the MSCI EAFE index which includes Europe, Australasia and the Far East. We can see during different periods we can get varying degrees of performance from each market. From 2009 to 2019 the US S&P 500 was the best place to be. From 1997-2007 it was the Canadian TSX that provided the highest returns. From 1984 to 1994 the greatest returns were found in the international markets. Having diversified global exposure allows investors to capture higher potential returns in other markets and lowers overall volatility over the long term.

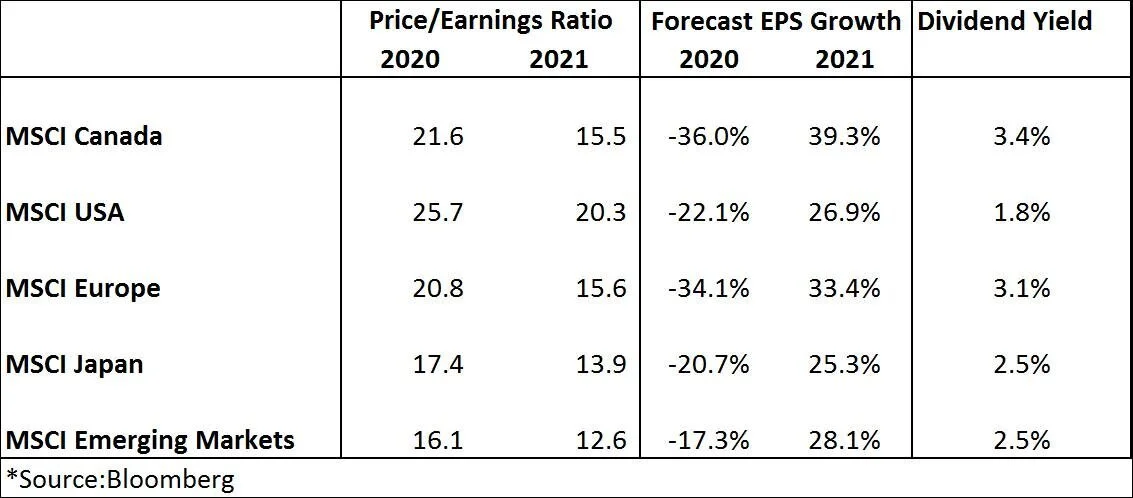

A third benefit to global investing is the ability to take advantage of regional differences in the economic cycle, valuation, earnings growth and momentum. In Table 2. we have compared different regional indices to their price-to-earnings ratio for 2020 and 2021 along with earnings-per-share growth and dividend yield. Currently we see that the US is the most expensive market by far. However, the US is also providing better visibility as earnings are more resilient than Canada or Europe during the recession. As we eventually get through the impacts of COVID-19 and look for economic improvement, both Canada and Europe may provide better cyclical recovery at more attractive valuation. Japan and emerging markets look particularly interesting as well as they both trade at a significant discount to other markets but does not have a worse earnings outlook.

Overall, we feel that there are good reasons to have a globally diversified portfolio holding all regions. It provides greater choice in finding the best opportunities globally, it provides diversification and lowers portfolio volatility, and offers an opportunity to enhance returns over the long term.

Should you have any questions, please feel free to reach out to me at 1-844-969-5242 (JCIC) | 416-366-1122 ext. 229 or by email at klam@jcic.ca

Kai Lam, CFA,

Vice President & Portfolio Manager

JCIC Asset Management Inc.